Georgia – Land of Golden Fleece

Georgia is considered to be one of the oldest homelands of metal processing in the world. From the Copper-Bronze Age, when man acquired metal,…

Read More

Georgia is considered to be one of the oldest homelands of metal processing in the world. From the Copper-Bronze Age, when man acquired metal,…

Read More

Construction & Building is the global business of creating physical infrastructure such as residential buildings, highways, bridges, factories, airports and power plants. Normally the…

Read More

Protein rich hazelnuts are sweet tree nuts that grow in temperate zones and its mainly cultivated in Turkey, which produces about 60% of the world’s…

Read More

Tea is the oldest Chinese culture, known in 1753 by a well-known Swedish botanist Carl Lynne, first described as a scientific name (Thea). Tea is…

Read More

Georgian mandarin is cultivated in Western regions of Georgia, in Adjara, Guria, Samegrelo and Apkhazia. Russia and Ukraine are leading Georgian mandarin export countries,…

Read More

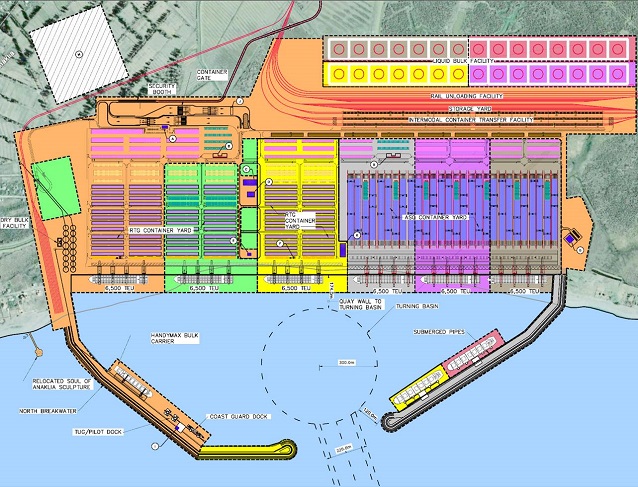

The Port of Anaklia is located on the shortest route from China to Europe, a route that has become a major focal point of Chinese…

Read More

Over the last decade electricity consumption in Georgia has grown largely in line with real GDP growth rate and reached 10.4 TWh in 2015. If…

Read More

An estimated 250,000 rural Georgians benefited from current support, EU announces third phase of assistance worth 230 million GEL 13, December 2017, Tbilisi –…

Read More

On November 15, after three years of technical talks, during the 7th Regional Economic Cooperation Conference on Afghanistan (RECCA-VII) in Ashgabat, Turkmenistan was signed…

Read More

In 5 years, Georgia will offer to the local and international visitors the Enguri River dam, which is planned to become a unique tourist…

Read More