It should come as no surprise that the U.S. leads the world in the absolute number of billionaires in the country — 536 in 2015. But what those billionaires say about America is less obvious.

Researchers parsed the global list of billionaires examining trends across the world over the past two decades. America’s billionaires demonstrated three things: fewer heirs, more financiers and higher rents.

Despite the high profile of billionaires like Donald Trump and the Walton family — whose wealth preceded their birth — the U.S. stands out worldwide for the comparatively low share of fortune inheritors. Just 29 percent of American billionaires grew their wealth from an inheritance, compared to 21 percent worldwide. And that share is falling.

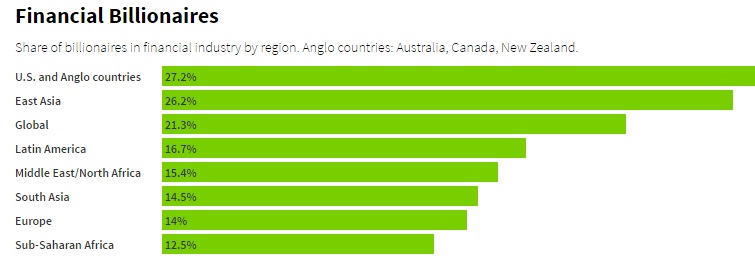

“In the U.S., extreme wealth is increasingly tied to finance,” study co-author Caroline Freund told ProMarket, a blog associated with the University of Chicago Booth School of Business. Financiers make up 27 percent of the mega-rich in the U.S., compared to 21 percent worldwide.

The biggest winners in the past 20 years: hedge funders. The U.S. stands head and shoulders above the rest of the world in the number of private investment professionals measuring their wealth in 10 digits, with names like George Soros and Carl Icahn near the top of the list. More than 80 percent of hedge fund billionaires in the world hail from the land of the free.

The biggest winners in the past 20 years: hedge funders. The U.S. stands head and shoulders above the rest of the world in the number of private investment professionals measuring their wealth in 10 digits, with names like George Soros and Carl Icahn near the top of the list. More than 80 percent of hedge fund billionaires in the world hail from the land of the free.